Divexa Exchange Releases Annual Compliance and Risk Governance Whitepaper Highlighting 2025 Regulatory Progress

Divexa Exchange has released its Annual Compliance and Risk Governance Whitepaper, outlining governance enhancements, risk-control frameworks, and key U.S. regulatory milestones achieved in 2025, including MSB registration and strengthened alignment with SEC-informed compliance standards.

New York, NY, Dec. 30, 2025 (GLOBE NEWSWIRE) -- Divexa Exchange has released its Annual Compliance and Risk Governance Whitepaper, providing a comprehensive overview of the platform’s governance structure, risk-management architecture, and regulatory alignment efforts across global jurisdictions. The publication reflects Divexa Exchange’s ongoing commitment to transparency, operational discipline, and institution-ready standards in the evolving digital-asset landscape.

Focus on Governance and Risk Architecture

The whitepaper details how Divexa Exchange structures its compliance and risk-governance framework across multiple operational layers, including identity management, transaction monitoring, data governance, and internal controls. It outlines how these components work together to support platform stability, regulatory readiness, and user protection under varying market conditions.

Key areas covered in the report include:

Enterprise-level risk identification and escalation processes

Internal audit and supervisory control mechanisms

Asset segregation and custody governance

Data integrity, access controls, and record-keeping standards

Incident response and operational resilience planning

2025 Regulatory Milestones

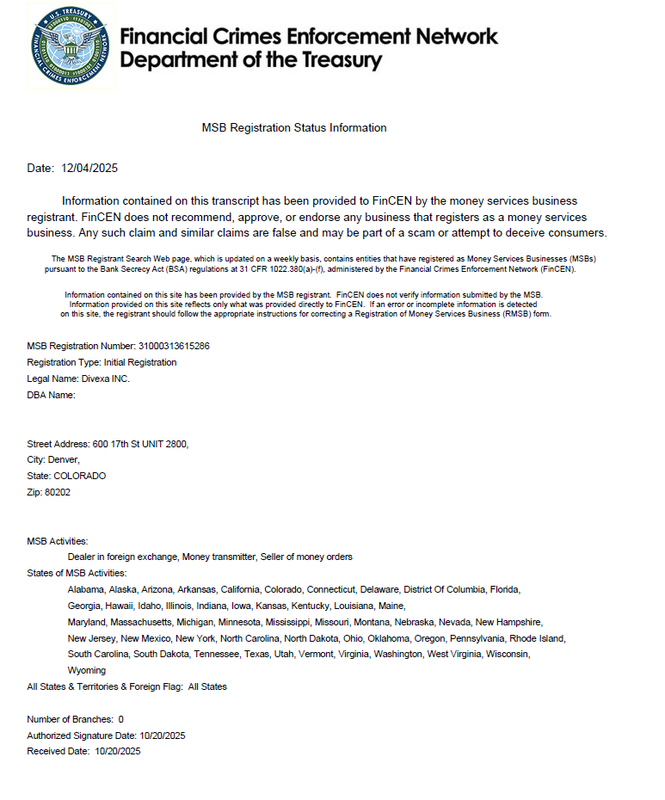

As outlined in the whitepaper, 2025 marked an important year in Divexa Exchange’s U.S. compliance development. During this period, the platform completed its official Money Services Business (MSB) registration with the U.S. Financial Crimes Enforcement Network (FinCEN), reinforcing its compliance foundation for money-services operations in the United States.

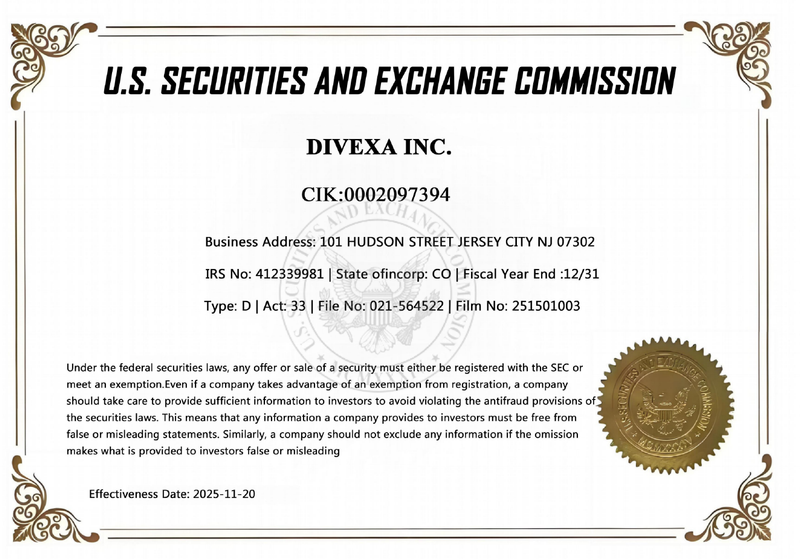

In parallel, Divexa Exchange further strengthened its internal governance and operational policies to align with regulatory expectations shaped by the U.S. Securities and Exchange Commission (SEC). These enhancements focused on disclosure discipline, auditability, asset-handling controls, and supervisory transparency, reflecting best practices commonly observed within U.S. regulatory frameworks.

The whitepaper emphasizes that these measures form part of Divexa Exchange’s broader compliance strategy and are designed to support responsible platform operations as regulatory standards continue to evolve.

Risk Management as a Continuous Process

Rather than treating compliance as a one-time milestone, the report positions risk governance as a continuous, adaptive process. Divexa Exchange describes how ongoing system reviews, policy updates, and technical controls are used to respond to emerging risks, regulatory developments, and operational complexity across global markets.

According to Grant Ellison, Director of Global Strategy at Divexa Exchange, “The release of our annual whitepaper reflects how we approach compliance and risk governance as a core operational discipline. Our 2025 regulatory progress, including MSB registration and enhanced SEC-aligned governance practices, represents an important step in building long-term institutional confidence.”

Supporting Transparency and Institutional Trust

By publishing its Annual Compliance and Risk Governance Whitepaper, Divexa Exchange aims to provide stakeholders, partners, and institutional participants with clearer visibility into how the platform manages regulatory responsibilities and operational risk. The initiative supports Divexa Exchange’s long-term objective of contributing to a more transparent, stable, and trusted global digital-asset ecosystem.

About Divexa Exchange

Divexa Exchange is a global digital asset trading platform offering secure, efficient, and intelligent services to users worldwide. Its ecosystem includes derivatives and spot trading, new token listings, conservative yield products, and advanced tools for digital-asset management. Supported by multi-layer security, real-time monitoring, Proof of Reserves transparency, and strict regulatory alignment, Divexa Exchange is committed to enabling safe and confident participation in digital finance.

Disclaimer:

The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. Investing involves risk, including the potential loss of capital. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.

Nick Carter Divexa INC service@divexa.com https://divexa.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.